I work for a tax-exempt organization so, instead of having a 401k, I have a 403(b). My retirement contributions are sent by my employer to the company that operates the 403(b), but the responsibility for allocating those contributions rests with me. I’m rather new to the “investing game” and I’m taking the time to research the various mutual funds available to me inside my 403(b) plan.

My 403(b) offers two different fund categories.

Category 1: Select Funds: These are basic mutual funds. By selecting among the various “select funds” I can create a completely customized “portfolio”.

According to the Securities and Exchange Commission, “A mutual fund is a company that pools money from many investors and invests the money in stocks, bonds, short-term money-market instruments, or other securities.”

According to Wikipedia, “In finance, a portfolio is a collection of investments held by an institution or a private individual.”

So, when I invest in a select fund (mutual fund) my money is pooled with the money of other investors and used to purchase stocks, bonds, etc. The combination of all of my select funds (mutual funds) equals the total value of my investment portfolio.

Types of Select Funds available in my 403(b):

Money Market

Low-Duration Bond

Medium-Duration Bond

Extended-Duration Bond

Equity Index

Real Estate Securities

Value Equity

Growth Equity

Small Cap Equity

International Equity

Let’s assume that I have $1000 in my 403(b) account. I can choose to allocate that $1000 in any manner that I wish. I can put 50% in the International Equity fund and 50% in the Equity Index Fund, or I could allocate 5% to Small Cap, 10% to Real Estate Securities, and 85% to the Medium-Duration Bond fund. The choice is completely up to me, as long as the allocations for my funds add up to 100%.

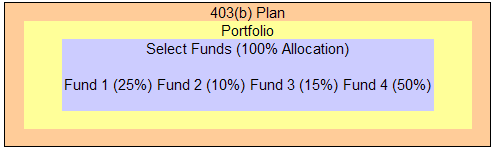

I’ve created the following graphic to illustrate how a 403(b) retirement account would work if my entire portfolio was invested in Select Funds (Mutual Funds):

—

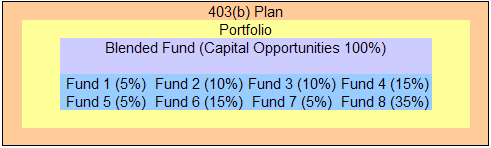

Category 2: Blended Funds: These funds invest in the various Select Funds. In other words, these are funds-of-funds.

Types of Blended Funds available in my 403(b):

Flexible Income

Growth and Income

Capital Opportunities

Global Equity

These funds provide inherent diversification and are listed by their assumed risk/return ratios. In other words, those looking for a higher return (and who also have a higher tolerance for risk) might choose to invest 100% of their contributions in the Global Equity fund. I can purchase one Blended Fund and still diversify my investments. Going further, I could also purchase multiple Blended Funds, but doing so might defeat the purpose of purchasing a Blended Fund. Blended Funds, by definition, are already diversified and categorized by risk/return assumptions.

—

My 403b provider offers Select Funds (which are mutual funds) and Blended Funds (which are funds that invest in the various Select Funds). I am free to decide how to allocate my investments.

1. I can choose to purchase only Select Funds (or just one Select Fund).

2. I can choose to purchase only Blended Funds (or just one Blended Fund).

3. I can choose to purchase Select Funds AND Blended Funds.

Confused? Most people are. I will confess, it takes a lot of effort to understand retirement funding and the various allocation options that are available. There are so many terms to understand, so many different opinions about what to invest in, and so many people trying to make a dollar “giving advice”. It’s amazing that something so important, so vital, is shrouded in difficult to understand terminology. Hopefully, as I move forward, I’ll gather more information and understand more and more about investing.

So, how have I chosen to allocate my money? I went the easy route and put 100% of my money in the Select Fund – Equity Index. This fund is an index fund, it invests in the stocks of the S&P 500, and it has a very low expense ratio. I like to keep things simple – very, very simple!

(One note: My 403b provider describes their funds-of-funds as Blended Funds. Certain mutual fund providers also offer regular mutual funds labeled “Blended Fund”. If you run into this term, be sure that you understand the difference.)

Please note: I am not a financial professional and I do not give investing advice. Take the time to educate yourself about investing.

Resource: For additional information about the 403(b), checkout 403b wise.

Resources: If you are looking for a great book about investing, may I suggest the following two? I really like them both.

Your post does a great job in demystifying retirement investment. One thing I’d like to point out is that investment is only a piece of the retirement puzzle. The key is really *saving*, and making sure you are saving enough to retire comfortably.