I will be depositing my paycheck Friday and sending in my first ever Roth IRA contributions. I recently opened two Roth IRAs, one for myself and one for my wife. The maximum contribution for fiscal year 2006 is $4000 per Roth IRA. Fully funding our Roth IRAs for 2006 AND 2007 would take $16,000. Wow. That’s a pretty big number. But, considering that I have “missed out” on several years of retirement funding, I HATE the idea of not fully funding 2006 AND 2007. Also, technically, I have until April of 2008 to fund 2007’s Roth IRA account, but I like the idea of starting 2008 with a “clean slate” of NEW goals. I have yet to decide exactly how much I am going to send to each Roth. I will talk it over with my wife and “update” you guys tomorrow. (I’m thinking that I will send $500 to each Roth…)

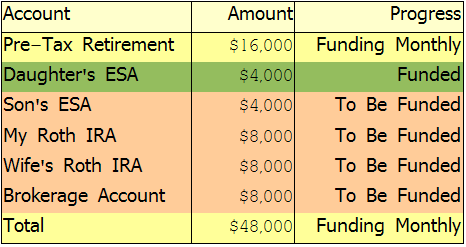

Speaking of “Goals”, I had created a “trying to save or invest 60% of gross income” goal. I’ve decided, for tracking purposes only, to change the name of my goal to “Saving $48,000”. I can “breakdown” my $48K goal into “mini-goals” and I can track my progress throughout the year. Here’s my progress SO FAR:

Im sure you can do it, considering you do not pay rent/mortgage.

Keep it up NCN, you’re doing well.

Very cool. How about a fourth column that shows the amount that has been funded so far?

Ceo,

I save up the full amount in my ING Direct Account and then “fund” the account all at once… as for the pre-tax retirement, it comes out automatically, so I just consider it as one of those things that “is” funded and “is not” funded, at the same time… is that confusing?