As a fan of the Atlanta Falcons, I am really looking forward to the upcoming 2009 – 2010 NFL season. Most of my enthusiasm centers around the Falcons’ second-year quarterback, Matt Ryan. Last year, as an NFL rookie, Ryan lead the Falcons to a surprising 11 – 5 record and a birth in the NFL playoffs. He did so while passing for more than 3,000 yards (only the second rookie in history to do so) while throwing only 11 interceptions. Ryan managed to lead his team like a veteran, as he avoided the mistakes commonly associated with rookie quarterbacks.

You are the quarterback, the game manager, of your own personal finances. Your goal is to minimize rookie mistakes so as to maximize your progress. Over the next few days, I’ll discuss rookie mistakes, and how to avoid them.

The Dreaded Overdraft

What is an overdraft?

An overdraft occurs when withdrawals from your checking account exceed the balance available in your account, resulting in a negative account balance. This can be referred to as being overdrawn or bouncing a check.

How can you avoid being overdrawn?

1. Maintain a balanced checkbook.

2. If you share a checkbook with your spouse, regularly reconcile receipts, checks written, ATM withdrawals, etc.

3. Record non-check transactions – ATM withdrawals, debit card purchases, online bill payments, auto-drafted payments – in your checkbook register.

4. Regularly access your checking account – online or via the telephone – so as to be aware of any fraudulent or irregular withdrawals from your account.

5. Avoid floating – writing a check before sufficient funds to cover it are in your account.

6. Stop depending on overdraft protection plans. Consider leaving a small buffer amount, say $50, in your checking account at all times, should other steps to avoid being overdrawn fail.

What is the cost of an overdraft?

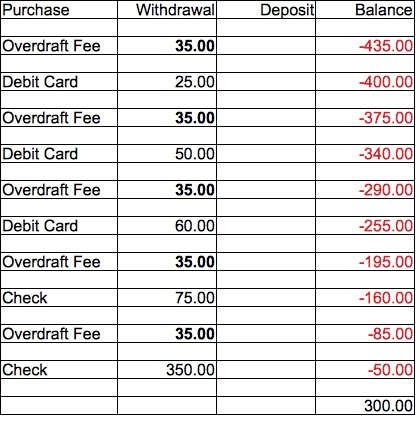

Most banks charge between $25 and $50 for each withdrawal processed on an overdrawn account. Also, most banks process withdrawals based on amount, starting with the highest amount first. Consider the following scenario –

Jack has $300 in his checking account. On Friday, he writes two checks, one for $350, the other for $75. His wife, Sara, uses her debit card three times, for purchases of $50, $25, $60. Jack gets paid on Fridays, and he is planning to “beat the check” to the bank on Monday, and deposit his paycheck before 2 pm. On Monday, however, Jack gets busy, forgets to make the deposit, and only remembers late that evening. The next morning, Jack looks at his online banking information, and this is what he sees –

Not only is their checking account in the red, they are now $175 poorer than they were just one day before, all because of poor planning.

Don’t be like Jack and Sara. Never use your debit card unless you are sure that you have enough money in your checking account to cover a withdrawal. Stop playing games with your checks and trying to beat them to the bank. For those trying to get out of debt, just one or two overdraft fees can reduce the progress you have been making with your debt reduction plan.

In our above scenario, Jack and Sara paid $175 for a one day loan of $260! – Banks are charging exorbitant fees, and customers are paying them, for very short term, very expensive, “loans”.

What are some questions to ask yourself / your bank?

How does your bank process overdrafts?

How does your bank handle deposits?

When can deposited money be accessed?

Would using money management software help to keep me informed about my balances?

If I am constantly dealing with overdraft fees, isn’t that a sign of poor financial management?

What can I do if I am a rookie and I have recently made this mistake? How can I get some (or all) of my money back?

Here’s what I would do, to try to recoup some of the money lost to overdraft fees –

I would call my local branch, and ask to speak to the manager. I would honestly explain my situation, and ask that a portion (or all) of the fees be refunded. I would remind the manager of my loyalty as a customer. I would acknowledge that I made a mistake, and I would inform that manager that I am now living on a budget and that I plan to be a better manager of my own finances.

If I felt uncomfortable speaking to a local manager, I might call the service number for the company which owns my bank, and speak to a customer service representative. Again, I would be honest and courteous, and I would ask that a portion (or all) of the fees be returned. I would remind the representative of my loyalty, and acknowledge my mistake.

The bank is under no obligation to refund any of your money, but many banks are willing to work with their customers. Be patient. Be persistent. Call until you reach someone to whom you can talk about your situation.

Final note –

If you have ever had to deal with the embarrassment of an overdraft fee, join the club. At some point in time, almost everyone you know, including yours truly, has goofed things up and found themselves in the red. Our goal is not to wallow in the mistakes of the pass, but to move forward, and to plan for success in the future.

I totally agree with ALMOST everything in this article… Well, that is everything except this weird excitement about being a Falcons fan. Honestly, how can anyone be “excited” about the Falcons! (Packers fan here of course)

In all seriousness, the important parts that connect with me are taking personal responsibility for the problem. By that I mean understanding it happens to everyone, but that you are going to take steps to prevent/correct it in the future.

In addition, you really should go and talk to the manager of your bank. You’d be surprised if you are open and honest what he/she may be willing to do. I’ve done this myself and had success with friends doing the same thing. Don’t just eat the loss without at least talking to them first!

HOLY S!!!!!!!!!!!!!!!!!!!I am a huge fan of the Falcons which is hard since I am from NY and 45 mins (on a good day) to the Jets/Giants.

My in-laws got me tix to the philly-atl game last year in philly. I thought I was literally going to get my ass kicked in my Falcon Gear.

YOU HAVE NO CLUE HOW PUMPED I AM! Sad really.

I am not a Falcons fan but I have overdrafted on my account. I pay $30 a year for overdraft protection…it has saved me money on more than one occasion….I still pay 10.00 overdraft fee for each occurrence…..I’m still a rookie even after 18 years of managing money.

Usually, if you talk to the bank manager, they will only charge you for the first overdraft fee and reimburse you for the rest. It saved a friend of mine $300.

this post hit home i just paid off the balance on my overdraft checking on tuesday . Go GIANTS !!!!!!!!!!

Some bank accounts have a free overdraft facility if you agree it in advance, so you don’t have to worry about going into ‘the red’ if it’s a temporary thing. For example, I have a $600 free overdraft on my checking account, and pay 0% interest on any debt below that.

Why would the debit card be approved if money was not in it?

Another tactic by banks

My credit union gave me $800 of free overdraft protection which they treat like another line of credit and charge something like 3% interest (way better than a big fee per incident). I can’t tell you how nice it is to not have to worry about getting a little overdrawn- especially since there is no interest charged for the first month. Of course I keep up with my balances and all that, but the “just in case” factor is really a load off my mind.

Wow, those are some draconian bank charges.

In Canada, I only get charged $5/month and interest if I go into my overdraft.

Saints Fan. Nice post. Another tip to avoid those overdraft fees is to set up alerts on your account. This way you are notified you when your account reaches a set balance and you can avoid overdrafting your account.

The most foolproof way is to have a monthly budget/spending plan that is based on the money you made *last month* and is already banked. Keep an index card with the available amount to spend for each budget category in your wallet, with a couple of extra cards stapled to it to record your spending as you go along so you can update your budget category totals, and refer to it rather than your checking account when making spending decisions. Do this and, assuming you keep accurate records of your spending and update your budget category totals, you will never, ever, overdraft your checking account. Plus you will find you make much more effective use of the money you do have, which is great.