In February of 2010 my wife and I purchased our very first home. We have a conventional 15-year mortgage and our plan is to pay it off in less than 10 years. Our stretch goal is to pay it off in less than 7.

As of May 31, 2011, we have made 15 regular mortgage payments – and several, additional, principal-only payments.

When I posted February’s update, we had paid off 5.72% of our mortgage debt.

When I posted March’s update, we had paid off 6.26% of our mortgage debt.

When I posted April’s update, we had paid off 6.90% of our mortgage debt.

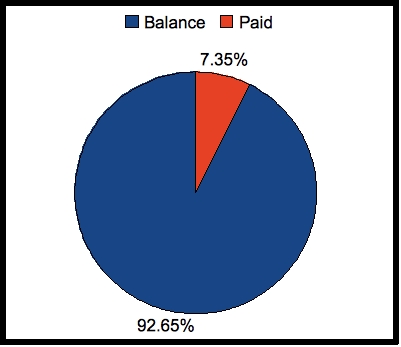

As of the end of May, we have paid off 7.35% of our mortgage debt.

Here is our most recent chart –

The chart below shows two percentages. The blue percentage is how much I still owe – the balance. The red percentage is how much I have reduced – the paid.

This chart does not represent how much of my house I actually own – it simply reflects how much of our mortgage balance we have paid. We actually “own†much more than 7.35% of the house, based on appraised value and initial down payment.

We have made 15 regular payments and have lived in the house for just over a year. Our contractual remaining term is 13 years and 9 months, but our actual remaining term is 13 years and 6 months.

May was a very slow month, in terms of debt reduction. I was able to scrape together just one principal-only payment – and it wasn’t very much. In terms of “life” – May was an extremely busy month. Unfortunately, blogging had to take a backseat for a few weeks. Thanks for sticking around, and I’m positive you will hear much more from me in June. You guys rock!

That looks like some decent progress. Unfortunately there are many people that have paid a large percentage of their mortgage obligation but if you were do do the same chart and show the equity they have in their house, it would be a much more grim picture. Keep up the good work! Looking forward to some good posts in June.