Over the years I have learned the true value of creating structure and following a routine. My wife and I use the following structured systems to control spending, plan for saving, and manage our finances.

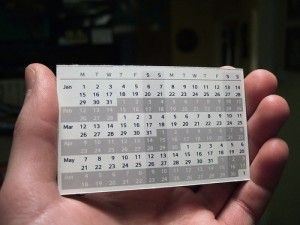

Monthly Calendar – Each month we sit down and plan out that month’s events and scheduled activities. We brainstorm and try to be thorough. We list doctors visits, school functions, church events, etc. Out goal is to know where we’ll be and when we’ll be there. This helps us know two things, vital to all other systems – how we’ll spend our time and where we’ll spend our money.

My wife is old school – and uses a simple spiral-bound day-planner. I prefer the calendar on my phone, which easily syncs with my computer and email.

photo by – Joe Lanman

photo by – Joe Lanman

Noted next to each event on our calendar, we approximate how much money that event might cost. If we are taking the kids to one of their ballgames, that needs to be in our budget. Or, if we’re taking the dog to the vet, that too needs to be in the budget.

Using a calendar to map out our month really helps us see where our money will be going. If you struggle to create your monthly budget, try building a monthly calendar – filled with spending approximations – first.

Family Budget - Once we have created our monthly calendar, we fine-tune our monthly budget. Since we have been doing this for many, many years, our budget remains (relatively) unchanged, from month-to-month. The calendar helps us make any changes that we might need to make, with increases or decreases in specific categories.

We use a simple zero-based budget for our regular monthly income. For my business income (writing here at No Credit Needed) I use a budget based on irregular income. We use the awesome You Need a Budget software to keep things nice and neat.

Meal Planner – This is a new one for us. We take our monthly calendar, and based on where we’ll be and where our kids will be throughout the month, we create a meal planner for our family. Basically, we figure out how many of us will be at home, how many of us will be elsewhere, and we plan a month’s worth of meals. This does two things – First, it allows us to fine tune our grocery budget. Second, it takes the pressure off of “what’s for dinner”. We know what we’re going to eat, weeks in advance. So far, the kids love it and we do, too.

Grocery Price Book - As odd as it sounds, I actually enjoy shopping for groceries. A few years ago, I created a printable grocery store price book (click to check it out and download, for free) to keep track of grocery prices at my favorite stores. The grocery price book helps me stock up on items, when they’re on sale, and also helps when creating our meal planner. (Do you see how all of these systems help with and connect to each other?)

Cash Management – Once we know what our month is going to look like, and once we’ve created our budget, it’s time to plan for cash spending. We use cash for daily or weekly purchases, like gas and quick trips to the grocery store. We use the envelope system (click to view a video that I made, explaining how the system works) to manage our cash. The calendar helps us plan for each week’s envelopes and each week’s spending.

Bill Payment - I have managed to schedule all but one of our monthly bills so that they arrive during the first week of each month. On our monthly calendar, I make a notation of when the bills are expected to arrive. Using our budget software (again, the awesome You Need a Budget, long-time site sponsor) and online bill pay, I plan for and schedule payments for each of our bills. We do have one bill which arrives during the third week of each month and it is auto-drafted from our checking account. In less than fifteen minutes, all of our regular, monthly bills are paid – and I can spend the rest of the month working, relaxing, finding ways to increase income, hanging out with family, but not worrying about paying bills.

Adding structure to our lives has lead to, in an odd twist, more freedom. We do not spend our time worrying about money or fretting over our finances. Instead, we have the systems in place, systems which work from a unified structure, to help us stay organized and prepared.

Thanks a lot, you’ve done a great work.

Cool advice, only I don’t think I could follow my budget to that level of detail. I can see always making enough for everyone in my family – if someone’s sick or is out, we can just refrigerate the leftovers.

I struggle with a budget, so maybe you can enlighten me. I split my bills between paychecks (twice a month), because I cannot pay them all at once upfront at the beginning of the month. Why do all budget programs treat it this way? I never see a semi-monthly or biweekly budget programs. They all do it on a monthly basis. How did you get to the point where you could pay the bills at the beginning of the month? The mortgage is the big culprit for us, as it eats a large chunk of pay, and would force us to eat on rice for 2 weeks 🙂

Hi there. I recently publish a three year comparison and how we spend our money and working on fourth year.

We started doing it for a fun, but after a couple of years it was really a bench mark – how are we doing and where are they going.

Year ago, we calculated median expenses and decided to freeze them. This is a good fun – it really tells you that there is point of breaking balls of price of gas (for example) when it is only 1% of your monthly budget.

Very interesting!

Thanks…