In February of 2010 my wife and I purchased our very first home. We have a conventional 15-year mortgage and our plan is to pay it off in less than 10 years. Our stretch goal is to pay it off in less than 7.

As of June 27, 2011, we have made 16 regular mortgage payments – and several, additional, principal-only payments.

When I posted February’s update, we had paid off 5.72% of our mortgage debt.

When I posted March’s update, we had paid off 6.26% of our mortgage debt.

When I posted April’s update, we had paid off 6.90% of our mortgage debt.

When I posted May’s update, we had paid off 7.35% of our mortgage debt.

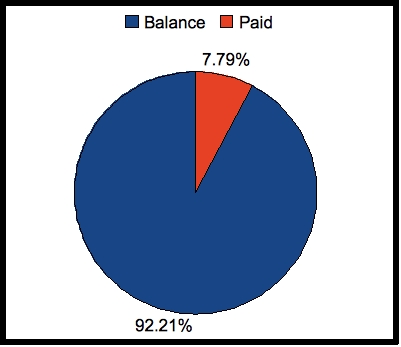

As of the end of June, we have paid off 7.79% of our mortgage debt.

Here is our most recent chart –

The chart shows two percentages. The blue percentage is how much I still owe – the balance. The red percentage is how much I have reduced – the paid.

This chart does not represent how much of my house I actually own – it simply reflects how much of our mortgage balance we have paid. We actually “own†much more than 7.79% of the house, based on appraised value and initial down payment.

We have made 15 regular payments and have lived in the house for just over a year. Our contractual remaining term is 13 years and 8 months, but our actual remaining term is 13 years and 5 months.

We altered our June budget to reflect our new goal of saving for a newer car. Due to this, we had less money for debt reduction. Even so, we managed to send a couple of small principal-only micro-payments.

Great progress, NCN!