My wife and I financed the purchase of our new home five years ago. We are working hard and paying off our mortgage early. Our goal is to own our home in less than ten years.

I use a simple pie-chart to track our progress. Having a visualization keeps us motivated and excited about the progress we are making.

We purchased our home in February of 2010. Hopefully, we’ll pay it off in less than 10 years – which is our stretch goal – but as of right now, we have shaved 6 months off of the length of the loan. Our progress was slowed, just a bit, when I changed jobs, but we are back – on-track – making principal-only payments on a regular basis.

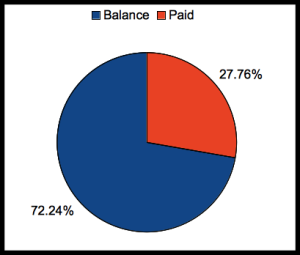

Here’s a chart with details for our current progress –

The percentages above represent the amount of our mortgage we have paid – 27.76% – and the amount we still owe – 72.24%.

Click here to check out our method for reducing our debt and paying off our mortgage.

Each month, we make our scheduled mortgage payment, plus an additional principal-only payment. (Some months, we make more than one principal-only payment.)

Keep in mind, this chart doesn’t represent our equity – it represents that amount we owe on our mortgage.

Here’s more on how we found the perfect house for our family and decided how much to pay for our new home.

We have reduced the length of our 15-year mortgage by 6 months. Blessings.

Congrats! We are following a similar plan and I figure any faster we pay it off means less interest. When we get to the final stretch we may use some money from our 6-month emergency fund to knock it out. Just an idea to consider when it’s time.

Kalie – When paying off our consumer debt, I used this same strategy. It works! Thanks for the comment.