My wife is a school teacher. She started teaching 10 years ago at the age of 22. In 20 years, at the age of 52, she will be eligible to retire. My wife contributes to a pension plan and will receive a monthly benefit. The amount of the monthly benefit will be determined by the amount she is paid during the final two years of her employment.

My job does not provide a pension plan, so I am aggressively saving for retirement. I thought it would be interesting to see where our savings might be in twenty years. I plan to save a MINIMUM of $20,000 (combined) per year in various retirement accounts.

I used this calculator to calculate results: Compare Savings Rates Calculator

For the purpose of this post, I entered “zero” as my starting value. I wanted to see what would happen if I discarded the fact that I already have SOME retirement savings. What if I had to “start” today?

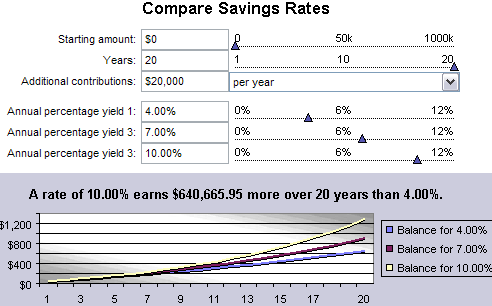

Here’s a screen-capture of my inputs:

I chose the following rates of return: 4%, 7%, and 10%

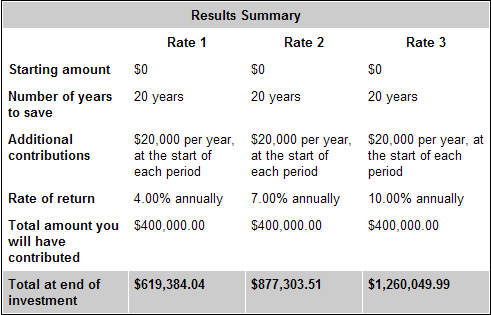

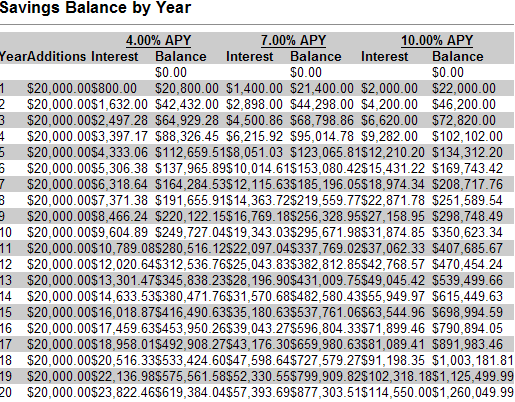

Here are screen-captures of the outputs:

Wow, there is a $600,000 difference between 4% and 10%! Of course, I’d love to make more than 10%! (Last year my retirement portfolio posted a 17.29% return.)

So, in 20 years, I’ll hopefully have between $600,000 and $1,200,000 saved in my retirement accounts, my wife will be ready to draw her pension, and life will be good.

Some notes:

While I entered “zero” as my starting point, I actually have over $33,000 saved in my retirement accounts.

While I assumed a return between 4% and 11%, the actual returns could be much more OR much less. In fact, I could easily LOOSE money. I am aware of these facts, but I will continue to save and invest.

I do not include Social Security income.

Inflation was not considered.

While I plan to save a minimum of $20,000 per year, in 2007 I actually plan to save $32,000 in retirement accounts.

You keep saying 11%, but you’re screen captures show 10%.

Nickel,

That’s b/c I am an idiot!